THE COMPANY:

- A biotechnology company (the “Company”) engaged in the development of an Influenza vaccine as its flagship product with others in the pipeline.

- The lead drug was in the pre-clinical phase of development, as of the date of valuation.

- The Company had raised financing through multiple classes of preferred stock and convertible notes.

- The Company had also applied for funding from the Biomedical Advanced Research and Development Authority (“BARDA”).

THE CHALLENGE:

The company came to us with a highly complex capital structure which included:

- Convertible notes with milestone / new funding based on contingent conversion terms.

- Multiple classes of preferred stock with cumulative accruing dividends payable in shares or cash.

- Top-down and Bottom-up analysis of market potential of the global Influenza vaccine market, as well as potential of the Company’s product vis-à-vis competition.

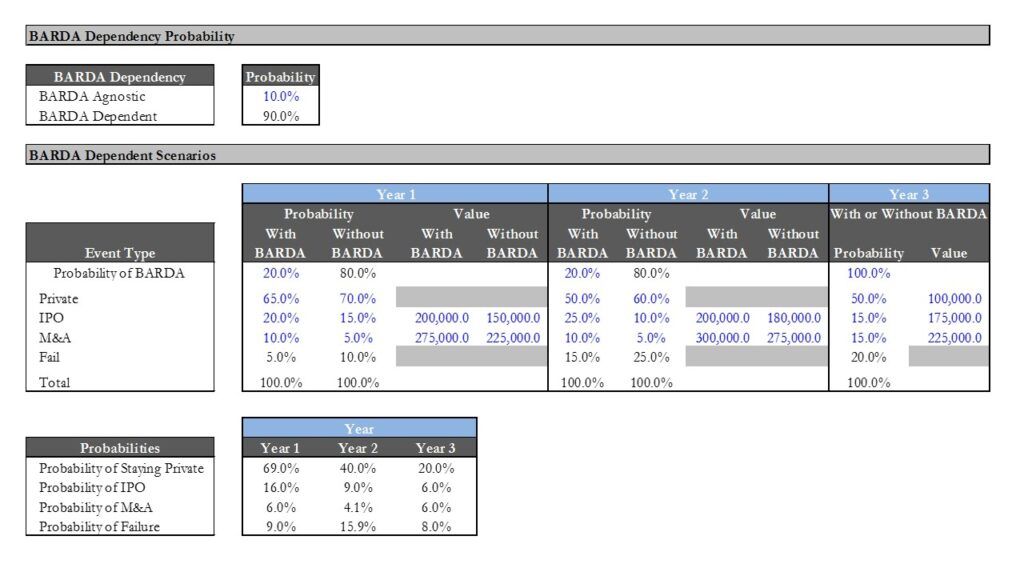

- Assessing the impact of the success or failure of funding by BARDA.

OUR SOLUTION:

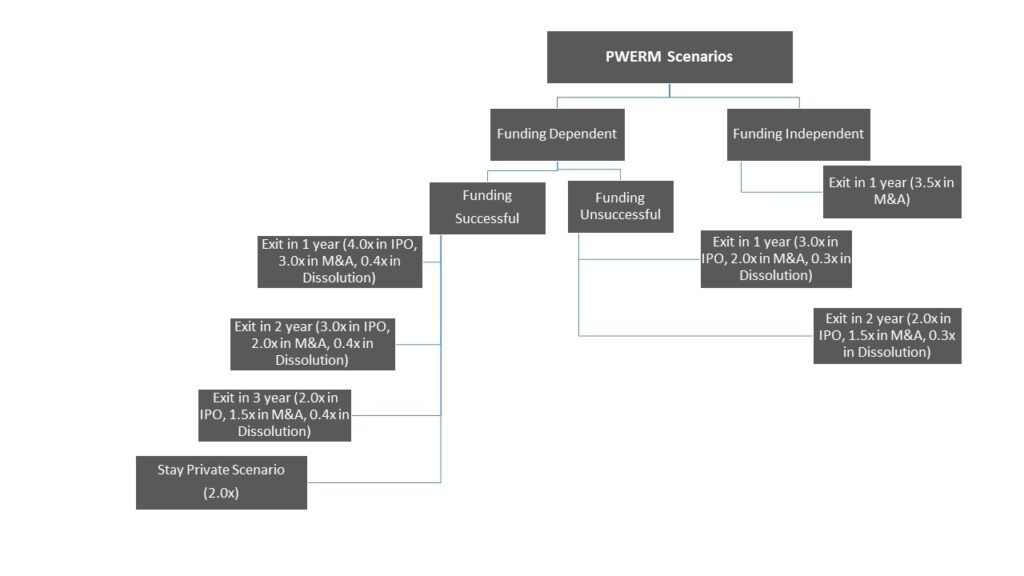

- Since the outcome of each business milestone was a binary event i.e., either success or failure, we did not apply the option pricing model in arriving at the fair market value of the common stock. Instead, we utilized the probability-weighted expected return method (“PWERM”).

- We began by defining the various possible binary outcomes for each operational milestone and assigned probabilities to each possible outcome.

- We then mapped out the possible exit scenarios and expected exit values at the turn of each outcome.

- Once the exit scenarios and valuation under each scenario were determined, we performed a waterfall analysis to determine the value of each class of security under each scenario. The future value thus arrived was assigned probabilities of the occurrence of the events and then discounted for term to exit to conclude the value of Common Stock.

A snapshot of our workings is presented below.